How to Get 10% off McDonald's Burgers for Life (as a multi-billionaire)

If you follow this guide, you will have 10% off all McDonald’s food for life. It’s not hard, and you can do it from the comfort of your computer. It not only gives you 10% off your own burgers, but it also gives you 10% cash back on everyone else’s burgers too. All you need is a brokerage account, a few minutes, and $66 billion.

Wait, what?

Where The Money Flows

Many of us have heard about the importance of spending locally. If you buy from your local restaurant, that money goes to the shop owner and local employees, who spend it at other local shops, which keeps wealth inside of a city. Conventional wisdom has it that if you buy a burger from McDonald’s instead of the local burger shop though, the profit goes to a bunch of rich guys on Wall Street. That’s not totally wrong, but it’s far from the whole story.

When you buy a burger at McDonald’s, that money doesn’t just disappear into The Economy, first it does a lot of work. It pays for the salary of the person who assembled your burger, the ingredients used to make the burger, and the salaries and profits at the companies that produce the ingredients for the burger. What’s left over goes on to pay the real estate costs of the restaurant’s land. It pays for the window stickers on the building that advertise the burger you bought. Then the money travels to the McDonald’s corporate office where it pays executives, advertisers, public coordinators, food photographers, food scientists, web developers and countless other employees that keep the brand afloat.

But even after paying for everything, there is still money left over. After all of its 2016 expenses, McDonald’s earned a total of $4.6 billion in profit. That’s equivalent to $14 for every man, woman, and child in America. If McDonalds were a privately owned business, all that money would go straight into the owner’s checking account. But McDonald’s is not privately owned, so where does that money go? Shareholders.

In this article we will first learn what shareholders are. Then we are going to buy enough shares of stock in the McDonald’s Corporation that whenever we buy a Big Mac, 10% of what we paid for the burger is going to show up again in our personal brokerage account, effectively giving us a 10% discount. It won’t be cheap.

The Birth of a Stock

Before we buy any shares of McDonald’s, or any shares of anything for that matter, we should ask the question: What is a share of stock? In essence, stock shares are an efficient way of keeping track of ownership of a company, when a company is owned by many, many people.

To illustrate how stock shares come into being, we are going to imagine the founder of a new fictional restaurant, Robert’s Burgers. Most business start off with one or two owners (the founders), and Robert’s Burgers is no exception. Rob found an investor who could see his talent for restauranteering, so by taking a loan from the investor, Rob bought a building in his home town and turned it into a burger joint. With a lot of skill and a lot of luck, Robert’s Burgers became a massive success, so they opened a second location, and a third…

It gets to a point where Rob is spending all of the profits from his current locations to keep opening more and more locations, but the profits aren’t coming in quickly enough to expand as fast as he would like. On top of that, Rob’s investor is ready to be repaid for his original loan. So Rob has the brilliant idea to “go public” with the company to get more funding. “Going public”, commonly known in the investing world as an IPO (Initial Public Offering), is the foundation of the modern stock market - this is how stocks are born.

Shares and Shareholders

To get started with the IPO, Rob creates 1 million shares of Robert’s Burgers out of thin air. He effectively declares that the company is now owned by the shares instead of being directly owned by him. Rob keeps 15% of the shares for himself, and sells 85% of the shares (850,000 of them) to a few investment banks, who raise the price and sell the shares to institutional investors, who then sell on the stock market to regular “retail” investors like you and me.

The investment bank’s analysts think that Rob’s company is worth at least $100 million, so they buy Rob’s 850,000 shares for $85 million, $100 for each share. This $85 million shows up as profit for the company, and Rob uses it to pay back his investor, open a bunch of new restaurant locations, and start a healthy business savings account. The investment bank’s shares make their way to the open stock market, and after a bunch of trading back and forth, the stock price settles at $150 per share.

Now Rob’s company has all the money it needs to continue to expand, but he only owns 15% of it. The other 85% of the company’s ownership is constantly in flux, as people buy and sell their shares of the ownership on the open stock market.

Because Rob now only owns 15% of the company, he only receives 15% of any profit the company makes, and the other shareholders get the rest. Furthermore since he is not the majority owner anymore, he needs to continue doing a good job managing the company or else he can be fired by the rest of the shareholders1.

Eventually Robert’s Burgers is so profitable that he can open as many new locations as he wants purely out of the profits from the existing locations. The company has extra profits left over, so it begins to pay shareholders just for owning shares of stock in Robert’s Burgers. These payments to the shareholders are called dividends.

This process of securing more funding through an IPO is very common when companies make the jump from medium to large size.

How to Buy 1 Share of McDonald’s

As we’ve learned, if you own shares of a company’s stock, you are entitled to any of the company’s profits. Profits come after all the company’s expenses, including investing in new equipment and locations. With its profits a company can either buy back shares or issue dividends. They both accomplish a similar goal, so for the simplicity of this article we will only be concerned with dividends.

A dividend is a payment that represents the profit that a share of stock earns, and it gets paid in cash to the person who owns that share through their brokerage account, which is sort of like a bank account for stocks. If we take McDonalds’ 2016 profit of roughly $4.6 billion and divide it by the number of McDonald’s shares in existence (roughly 861 million), we get a figure of $5.44 in profit per share, which was paid in 2016 to each shareholder’s brokerage account as a dividend.

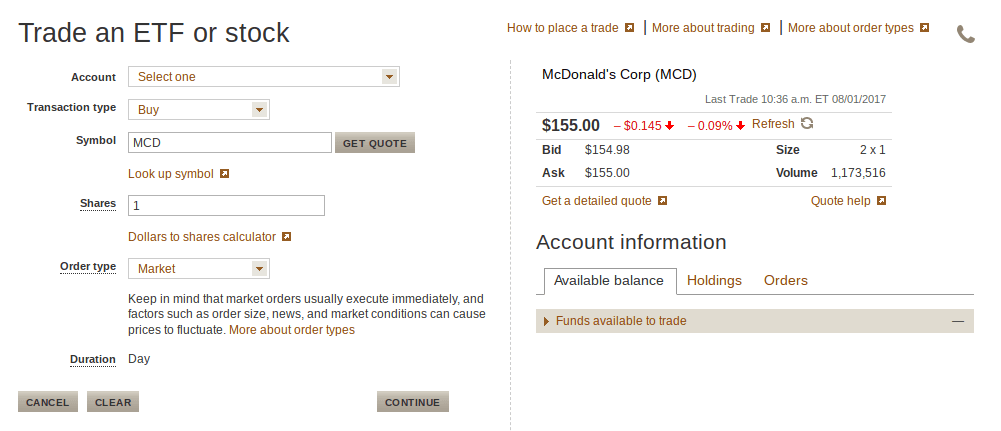

So McDonald’s sells burgers, makes a profit, and distributes that profit to its shareholders as dividend payments. If we want to get in on those dividend payments, all we need to do is open a brokerage account and purchase a share of McDonald’s for $120, and we will earn 0.000000116% of McDonalds’ profits every year in perpetuity.

If you owned 10 shares in 2016, you would have gotten $54.40. If you owned 1000 shares, you would have gotten $5,440 - enough to turn around and buy 3 Big Macs every day of the following year. The more of the company you own through shares of stock, the more of the company’s profit you receive.

How to Buy 453 Billion Shares of McDonald’s

Now that we know what a share is, how many shares of McDonald’s would we need to own in order to earn 10% back from every McDonald’s purchase we make? There’s going to be a lot of numbers, so if numbers squick you just skip the bulleted section.

-

In 2016, a Big Mac at McDonalds cost $3.99. McDonalds’ overall profit in 2016 as a percentage of revenue was 19%. So if we assume that a Big Mac is average for McDonald’s in terms of profit margin (bear with me for the sake of explanation), then on a $3.99 burger purchase, $0.76 is profit. That profit gets paid directly to McDonalds’ shareholders.

-

If we split that $0.76 per burger profit into the total amount of McDonalds’ shares, 861 million, we get a figure of $0.00000000088 per share. So if you own one share of McDonald’s stock, any time anyone buys a Big Mac in America, you earn $0.00000000088.

So to earn $0.40 every time someone buys a Big Mac, you would need to own 453 billion shares of stock, representing just over half the company. If you owned these 453 billion shares, you could waltz into a McDonald’s, buy a Big Mac for $4, and $0.40 (10% of your purchase) would filter all the way through the company and show up in your brokerage account as a dividend payment a few months later.

One thing to realize is that this doesn’t include all of the taxes. You are giving money to Uncle Sam at every step of the way. If you are in California you pay 7.5% as sales tax on top of your $4, then a roughly 30% corporate tax is one of the expenses that figures into the profit figure of $0.76, and finally when you do get paid your dividend, you owe up to 20% in federal qualified dividend tax plus 13% in CA state income tax. If my calculations are correct, shareholders only get to keep 46% of the profit in the end, in California at least. The other 54% goes to the state and federal governments.

Final question: How does one actually go about acquiring over 50% of a company’s outstanding shares? I lied a bit, in reality you can’t just call your broker and buy that many shares all at once, even if you have mad dosh. The nature of the stock market order book means that you couldn’t realistically buy that many shares on the open market, and you would instead need to get some lawyers and do a big-business-style corporate buyout. For McDonald’s, it would likely cost hundreds of billions of dollars.

But hey, then you would get 10% cash back on everyone’s burgers.

Footnotes

- Technically, fired by the board of directors. But the board of directors is elected by the shareholders.

P.S. Yeah I know, McDonalds habitually gives out free burgers for life to billionaires, but if you knew that then it would ruin the premise of this article.

Anything inaccurate in this article? Please point it out in the comments! Thanks!