Thoughts on the MakerDAO USDC Proposal

Update 9/5/2020: USDT, a much shadier stablecoin than USDC, has just been onboarded as well. More details below.

Note: I was originally going to post this article on the MakerDAO forum as a response to the Proposal for Collateral Onboarding of USDC, but it seems that they have halted signups, probably due to the influx of visitors during this crisis. So this response will live on my own website.

As a long-time Ethereum community member, I am not happy about the proposal to add USDC as collateral to MakerDAO, but I don’t really see any way around it in this market (with one notable exception, read on). I see the USDC collateral proposal as “throwing up the white flag”, in essence admitting that as currently designed, MakerDAO cannot function independently without bringing in value from the legacy financial system to back its liabilities (DAI), i.e. that its only way forward is to take on collateral that’s under the jurisdiction of the US gov’t.

Basically, MakerDAO is having a similar “bottomed-out interest rate lever” problem as the US is currently having, but while the US government can then go on to lend unlimited amounts of dollars to alleviate their liquidity crunch, MakerDAO cannot lend unlimited amounts of DAI, because unlike the US dollar, DAI needs to be fully backed by real collateral at all times.

In other words, just as the dollar used to be on the gold standard, DAI is currently on the ETH standard. DAI is MakerDAO’s dollar, and ETH is MakerDAO’s gold. But unlike the US government, MakerDAO can’t just “get off the gold standard” and rely entirely on the reputation of their monetary policy. MakerDAO has to play within the rules.

This is a necessary restriction, but it severely limits the number of crisis response options MakerDAO has compared to a sovereign government with unilateral control over their currency.

What’s The Crisis?

Right now, MakerDAO’s DAI, which is supposed to trade at $1.00, is trading at $1.04. To fix this, MakerDAO usually lowers the DSR/SF, which encourages borrowers to mint more DAI to sell into the market. But they have already lowered the rates to effectively zero, meaning that they’re using their policy lever on full-throttle and it’s still not enough.

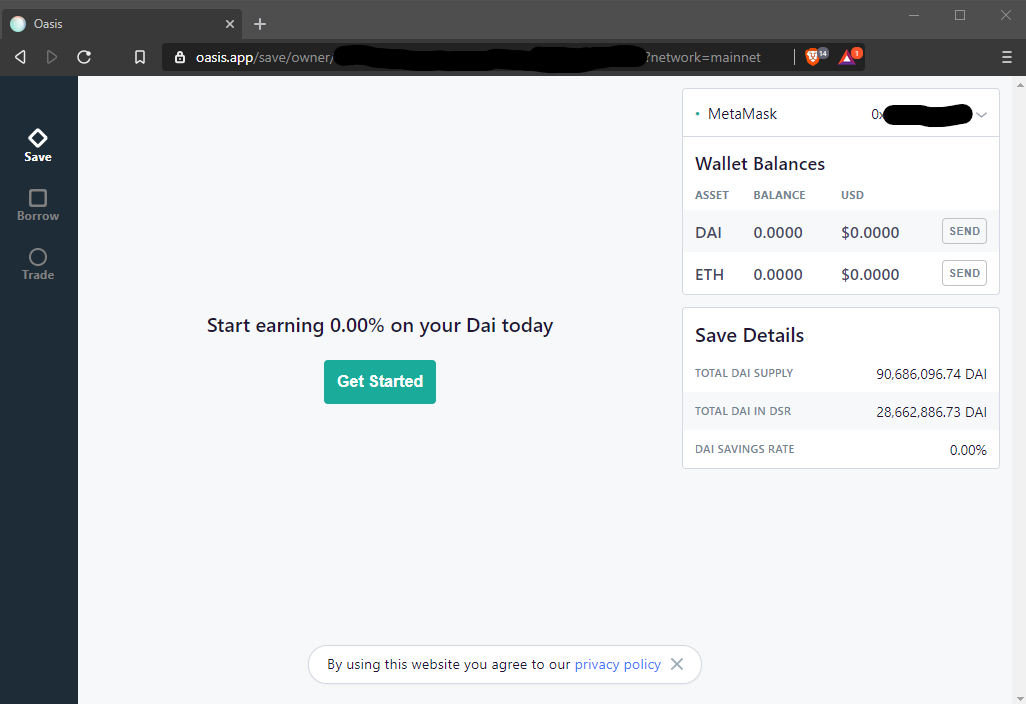

As of yesterday, MakerDAO’s savings app advertises that you can “Start earning 0.00% on your Dai today”. That’s a zero-rate environment if I ever saw one.

Unfortunately, having used their rate lever to its maximum effect, MakerDAO has a limited amount of tools left to restore DAI to $1.00 at this point. One of their ideas is to allow USDC, a cryptocurrency backed by Coinbase and in turn backed by the US Government, as collateral. However, USDC can be permanently frozen by Coinbase for regulatory reasons. Thus, there is a risk that US regulators could find some reason they don’t like DAI, then stop the system by pulling the USDC portion of DAI’s backing without notice. This could cause DAI holders to take a haircut, assuming that the system cannot be recapitalized by diluting MKR, as MKR holders are lenders of last resort.

MakerDAO’s short-term options seem to be to either accept this risk and add USDC collateral, or watch the system slowly collapse.

Why Didn’t MakerDAO See The Crisis Coming?

Such a liquidity crisis has been brought up in discussion before, but MakerDAO didn’t foresee it ballooning into the big issue that it is currently. Here’s a forum post from five months ago that takes the type of crisis we’re seeing right now as a hypothetical, and hints at a possible emergency need to add additional collateral types:

What options are left to maintain the peg in a scenario where the stability fee is 0, the DSR is 0 but Dai is still trading at a premium?

I think the answer to this is to on-board new collateral types that we can hopefully use to increase supply. It’s admittedly not a great answer, but in the scenario you’ve outlined above, I think that’s the only option.

John Gault then hints at the possible need for negative interest rates, and describes how MakerDAO’s current design doesn’t support them:

I think the DSR would need to be baked directly into Dai as opposed to the opt in option. IMHO this kind of a big deal given the current rate environment. It implies the current Maker system is incompatible with a negative rate environment.

In other words, the current type of liquidity crunch was foreseen (DAI premium + 0% SF/DSR), and the solutions were brought up at that time (new collateral types being not a great answer, and negative rates being a better answer but incompatible with the current system).

I’m not in a position to judge whether this was a failure on the Maker Foundation’s part, or whether the magnitude of the current liquidity crisis is truly larger and more intractable than anyone could have anticipated.

Why Is The Crisis Happening?

The way MakerDAO is designed, DAI being off the peg is supposed to create an arbitrage opportunity, in other words, it’s supposed to provide a profit incentive for people to sell DAI back down from $1.04 to $1.00 where it’s supposed to be. So why isn’t this happening?

Let’s get into the details of how a trader profits from the spread. To take advantage of it, you would (1) open a Vault, add collateral and mint DAI, (2) sell the DAI at over-par (say $1.04), (3) wait for MKR holders to lower the DSR and SF to bring more DAI onto the market, then (4) buy back your DAI at or below $1, closing your Vault and making your 4% profit. The fundamental issue right now is that the borrowing rates are effectively zero (0% DSR, 0.5% SF), but DAI is still over par ($1.04). So, the reason the peg is still too high is that this arbitrage cycle is currently broken. This is because due to the current ETH price volatility and the perceived inability of MakerDAO to restore the $1.00 peg, people see it as too risky to open up a Vault.

During this liquidity/crypto/coronavirus crisis, whatever you want to attribute it to, everyone is worried that there is no floor on the price of ETH (and BAT), thus nobody wants to open a Vault against ETH to mint DAI. This results in the market silliness we have right now, where anybody could mint DAI at a 0.5% stability fee and turn around and lend it on Compound or dy/dx for ~15%, but they don’t because they’re worried that ETH will fall and liquidate them.

Here’s a scenario that illustrates why 15% is not nearly enough reward for a market maker to want to take on this risk. Say for example as a market maker that you have $100,000 worth of ETH laying around that you could mint DAI against to take advantage of this spread. Say that you want to set a conservative liquidation point on your Vault, like $30/ETH, in case ETH drops a lot from its current $116 price. This means that at MakerDAO’s 150% liquidation ratio, you could mint up to 17,241 DAI on your $100,000 worth of ETH (100,000 * (30/116) / 1.50). Let’s say you estimate that it will take 3 months for the DAI liquidity squeeze to be gone (Corvid blows over, ETH 2.0 launches and pumps price, whatever). At 15% per year (minus the now-inconsequential stability fee of 0.5%), that amounts to roughly ($17,241 * (0.15-0.005) * 3/12) or $625 of profit.

So, in summary, $625 in profit on $100,000 outlaid over 3 months. That’s only a 2.5% annualized return on your ETH, nowhere near enough of an incentive to compensate you for such a dangerous Vault.

Why are Vaults so dangerous in this climate, even with a low liquidation point? Let’s go back to our hypothetical arbitrageur. This is how you get bamboozled: The price of ETH starts dropping again, to say $70. Your $30 liquidation point no longer looks safe, and you have no more ETH to add as collateral because you’re all-in on this Vault. So you decide to pull your DAI back out of Compound or wherever you lent it, so that you can repay your Vault. But oops! Compound doesn’t have any liquidity, all of their DAI are still being lent out. Your only option left is to deleverage and take a big loss on your ETH stack, because the cDAI you’re sitting on is worthless until Compound has DAI liquidity again (or maybe it’s not completely worthless, but it’s at least trading way below ITS par on the “tertiary” markets - e.g. Uniswap).

In essence, large risk and small reward does not make a good arb opportunity. Thus, people are not currently arbing the 0.5% - 15% spread.

The Secondary Market Fix

One thing that could help this market greatly is a big rate jump in the secondary markets to compensate market makers for the Vault risk, and I would contend that the rates are currently trying to jump but are being artificially capped. Most of the liquid secondary markets all seem to be hard-capped at around 15-20% or so for DAI interest rate, and that’s seemingly not high enough, because they are at over 90% utilization and we still don’t have enough DAI on the market.

In effect I would say this is a failure of the secondary markets because DAI cannot be borrowed in volume at all, not at 15%, not at 100%, not at “I’ll pay you back double tomorrow” percent. To fix this, I would urge secondary market providers to update their rate calculation to allow the DAI rates to climb to wherever they need to be in the very short term. I could be wrong, but my hunch is that we have enough DAI borrowers to support a higher secondary market rate than the current one, which would help cushion this liquidity crisis, though probably not solve it. (Update: Since USDC was added as a collateral type to MakerDAO, DAI liquidity has increased, so a rate model update is no longer critical.)

On a macro level, such a situation with very high secondary market DAI rates would effectively begin to move liabilities out of MakerDAO and into the secondary markets, functioning as an “escape hatch” where some of MakerDAO’s liabilities can chill outside of the MakerDAO system as cDAI, and the DAI that backs this cDAI can start being used to close MakerDAO Vaults and pop out of existence, until it’s eventually called on by the cDAI owner and needs to be re-minted. We desperately need some mechanism for MakerDAO to start shedding liabilities (DAI), as the pressure of liquidated Vaults is relentlessly pushing, pushing, pushing to try to shrink the MakerDAO system, but can’t due to the DAI liquidity crunch. The only other alternative is, well, adding an uncorrelated collateral type like USDC to shore up MakerDAO’s assets.

On Negative Rates

As a final point, if we had access to negative interest rates to “pull” DAI value from DAI holders, we wouldn’t have to rely on the secondary markets to “push” DAI out of DAI holders’ wallets by incentivizing them to lend. I honestly find it quite unfortunate that MCD DAI was designed in such a way that negative rates are not possible. All the cool countries are doing it nowadays, and it could really give DAI holders the proverbial kick in the butt to bring their money out of savings. If people’s DAI started eroding away, I guarantee we would see a lot more of it hit the market, whether lent or sold, to provide market liquidity and end this crunch. And if not, it would start taking liabilities off of MakerDAO’s books, a second avenue toward system stability.

The macro problem with not having access to negative rates is that while we can swing the lever with impunity to incentivize people to pull DAI off the market (DSR as high above inflation as it needs to be), we can’t swing the lever as far the other way to incentivize people to put their DAI on the market. This is because the DSR can only be 3% lower than the 3% USD inflation rate before it hits 0, and MakerDAO’s architecture doesn’t support negative rates.

Conclusion

To simplify everything, MakerDAO has demonstrated that it can grow its DAI liabilities when needed, but that it can’t shed its DAI liabilities when needed. Adding USDC is a desperate attempt (and perhaps the desperation is warranted in this case) to artificially raise the assets of the system to meet its liabilities, because the system’s monetary policy is not robust enough to reduce its liabilities without outside intervention.

In conclusion, adding USDC as a collateral type is a band-aid fix for the inability of the MakerDAO system to properly set negative rates, and this liquidity crisis may have abated a bit if the secondary markets had a higher DAI lending rate cap than 15-20%. Is USDC a band-aid that we need right now? Possibly so. But we wouldn’t have needed it if these two mechanisms were functioning properly.

This crisis should be a wake-up call, an opportunity for the Maker Foundation to reflect on MakerDAO’s policy tools and set a roadmap to adjust them over the long term. If it were up to me, I would be working on a MCD 2.0 right now that supports negative interest rates. Then I would migrate everyone in the style of the SCD-MCD migration, and finally, unwind USDC off the books by gradually increasing its liquidation ratio until all positions are either unwound or liquidated.

Update: While I was writing this article, the USDC proposal was passed. It’s official, MakerDAO has brought in liquidity from traditional finance, and is now tied to the US regulatory environment.

The first and only fully decentralized stablecoin, after three years, is now partially backed by US dollars in Coinbase’s bank account.

Update 2: Liquidity has rolled in from the new USDC-backed vaults, and the DAI peg has been restored. Secondary market rates are dropping. At the price of adding USDC to MakerDAO’s books, the current crisis has been averted. Looks like it was a glitch in Coinbase’s price graph or else I was reading it wrong. DAI is still at $1.03. Curious to see what happens over the next few days.

Update 9/5/2020

MakerDAO has now greenlit the onboarding of a second stablecoin, USDT. Unlike USDC, which is at least operated under US jurisdiction and has a proof of reserves published by a reputable accounting firm, USDT operates in the British Virgin Islands with no meaningful audits and an obscure legal structure. Here is what MakerDAO themselves have to say about this currency that they are going to allow to help back the MakerDAO system:

Tether has a complex ownership structure and is closely related to Bitfinex. There are several companies and individuals involved, Tether International Limited, Tether Limited, Tether Operations Limited, Tether Holdings Limited and others. The Bitfinex officials are also responsible for setting up the Tether company structure, which is the link between the companies. Due to lack of relevant expertise, we choose to omit any legal risk analysis surrounding the company structure.

The MakerDAO team also notes that USDT was found at one point to only be backed $0.74 on the dollar by real cash:

In 2019 the New York Attorney General’s (“NYAG”) office filed a suit alleging that Bitfinex used Tether reserves to cover $850 million in lost customer funds. Bitfinex claimed that Crypto Capital, a financial services firm offering shadow banking services for several cryptocurrency businesses, defrauded Bitfinex out of the $850 million. Court filings revealed that, consequently, Tether only held $2.1 billion in cash and cash equivalent securities. This figure implied that each USDT was backed by only $0.74 instead of a full $1.

At least MakerDAO is planning to limit their exposure to USDT for now, which is better than nothing:

Due to USDT’s noted history of opaqueness and fractional reserve, we recommend an initial LR of 150%. This is the only parameter that can protect Maker in the instance where these risks materialize again. Additionally, since currently no other large lending protocol allows USDT as a collateral asset, there is potentially large demand waiting to flow into Maker from other protocols (~78.5m). Generating Dai against USDT could be an attractive avenue towards yield farming. Additionally, a future change to a lower LR is always possible and can be done smoothly. The opposite, however, is not true. Given that Maker would be the first significant DeFi application offering collateralization against USDT, a conservative risk premium to start should also be considered. We suggest 8%.

I’m let down that MakerDAO would even consider onboarding a stablecoin that is so obviously shady, and was found in the past to not even be fully backed. It doesn’t make sense to me.

More Articles Tagged #cryptocurrency

-

The Block Size Debate: 5 Years Later

27 August 2020 cryptocurrency tech -

Long Live Bitcoin (on Ethereum!)

14 October 2019 cryptocurrency tech -

How to Limit the Bandwidth of Bitcoin Core on Windows, Mac OS X, and Linux

16 July 2015 cryptocurrency tech tutorial